Operating senior living communities can have its challenges. Ensuring the highest quality care is paramount and at the top of the list. One creative and unique way to ensure outstanding quality is to develop key strategic partnerships with all the community resources at your disposal. For senior living communities, this means putting a special focus on those relationships with home care, personal care and hospice companies, by utilizing each other’s services and leveraging those relationships for optimum care and value.

To create better understanding and a common language, home Care refers to skilled Medicare companies that provide intermediate home care services such as nursing, physical therapy and occupational therapy. Personal care refers to those non-medical companies that provide companion, personal care and complex personal care services and are usually private pay. Hospices are those companies that provide palliative and end-of-life care services paid for by Medicare or insurance companies.

If a nursing home or assisted living facility doesn’t create and maintain these partnerships with home care, personal care and hospice companies, they are severely disadvantaged when working with hospitals. From the hospital’s perspective, without these vital partnerships, there is a loss of quality outcomes and an unnecessary increase in inappropriate readmissions. If your community cannot overcome these stipulations, you could potentially lose referrals as well as the ability to participate in accountable care organizations.

In addition, strong partnerships will allow you to have the ability to help people age in a place which advances both your mission and business objectives. Most senior community’s economic engines are fueled by keeping a strong census in their facility. “Closing the back door” is critical to maintaining and building a strong census and creating a strong relationship with home care, personal care and hospice. All of these functions will assist in your efforts to differentiate your community in an ever increasingly competitive marketplace, and having the ability to offer home care and palliative medicine services will help you promote yourself through referral sources and the community at-large.

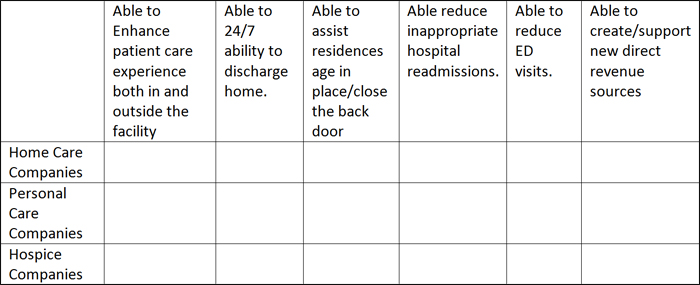

The value proposition matrix below will help you identify those companies that will bring you the most value and be good partners.

Below is a value proposition matrix to identify companies that would bring the most value, while also providing a great partnership. A senior living community with skilled nursing and assisted living can effectively go about developing several strategic partnerships if using this matrix and using it as a checklist.

A real world example

A senior living community with skilled nursing and assisted living developed several strategic partnerships. But first it had to correct one big problem: too many cooks in the kitchen.

This senior community had nine hospices, 10 home care companies and eight personal care home health companies all vying for the same referrals. The variances in the services delivered were all over the map as well as the ability to get and manage reliable data.

Several processes were put in place to help this senior living community improve its operations.

Mini RFP process

The first thing the executive director in this community did was make all these companies aware he was going to select three providers in each category. A bold move, but it worked. He went through a mini RFP process using the value proposition matrix to select his team.

If a patient came to the facility already working with another provider, he continued to allow them to work in his building; however, the referrals from within the building went to one of the pre-approved team facilities. This process set a precedent for better team work, data sharing, use of EMR and better overall outcomes.

Worked together to reduce unnecessary ER visits and inappropriate hospital readmissions

When the team could, they looked for opportunities to avoid an emergency department visit and sent appropriate patients directly to one of the “team” members. Home care, personal care, and hospice companies worked creatively to keep patients safe and secure in the home setting.

If a patient did go to the ER, the team worked diligently to send them right back allowing that company to better manage their care. If the patient was a fall risk, a personal care referral was made. If the patient met hospice eligibility guidelines, the appropriate referral was made.

There are continuous process improvement initiatives around ER transfers inside the post-acute setting (the team). Using this approach, this senior community learned to master CHF, pneumonia and myocardial infarction. Now this facility is better prepared for the next set of penalized diagnosis-related groups.

Developed a general inpatient (GIP) hospice program

One of the three hospice team members worked with the senior community to develop a GIP cluster bed program. This was an excellent development of a program element that greatly improved the community’s ability to reduce readmissions and create a new revenue stream.

This was accomplished by turning two beds at the end of a wing into palliative care suites. For patients in the community that met GIP criteria, they were cared for in one of these palliative care suites to treat and get their breakthrough pain or out of control symptoms under control. This helped make a discharge home more manageable.

Instead of going to the hospital, those patients discharged home who developed GIP related issues could be admitted to the palliative care suite for care. All appropriate care was handled by the team, and the facility was reimbursed $375 per day from the hospice for the use of the bed and facility’s services. The GIP level of care is allowed and encouraged by CMS. Ultimately this provided the community the ability to generate $260,000 in one year from the hospice providing GIP care, in addition to driving better outcomes.

Data Tracking

One of the final steps was data tracking. The senior community monitored the team members as well as physicians’ data and compliance through benchmarking.

This facility started to share the data with hospitals, which resulted in the facility becoming part of a hospital’s post-acute provider networks. This benefited all the members of the “team” and allowed the facility to customize their data, and actually provided more information than is often requested to help create a clear picture of the efforts and results.

The senior community took advantage of what the home care and hospice CMS conditions of participation allowed, and from that built its delivery model and service mix. The best example of this is how the senior community and the hospice company entered in a GIP contract, and then used that contract to develop a GIP cluster bed/ palliative care suite program.

The partnership with the personal care company was creatively used in a number of ways. One example is how a small office space was given to the three personal care companies that rotated its use, so that a caregiver was on the campus seven days a week, 10 hours per day. The personal care company paid for this staffing and, in part, the caregiver would provide a number of services such as helping with discharges home, assisting with transportation home (if needed), and providing three hours of “tuck-in” service at home. This safe discharge home program was paid for either by the family or the facility.

Though this is one study, the results provided prove that when applied correctly, a senior community can create longstanding and worthwhile partnerships with home care, personal care and hospice companies. The opportunities to work with not only these three types of organizations, but other community resources will help senior living communities be stronger and more financially viable companies.